Introduction

Medical emergencies never knock before entering your life. A sudden hospital admission—whether due to an accident, heart condition, or critical illness—can burn through your savings in a flash. In a country like India, where healthcare inflation is rising at a steep 14% annually, Health Insurance Plans are no longer an option; they’re a financial necessity.

Whether you’re exploring care health insurance, comparing medical insurance quotes, or seeking private medical insurance for peace of mind, selecting the right policy today can save you lakhs tomorrow. This guide breaks down the top 5 health care insurance options in India for 2025, each chosen for its reliability, cost-effectiveness, and real-world benefits.

Why Investing in Health Insurance Plans is Crucial in 2025

With the cost of surgeries like cardiac bypass rising to ₹5–8 lakhs and cancer treatments crossing ₹20 lakhs, health insurance is your buffer against unexpected financial turmoil.

A few compelling reasons to invest now:

- Rising Illness Burden: Lifestyle diseases such as diabetes, cancer, and cardiovascular conditions are affecting millions.

- Cost of Delay: 62% of healthcare costs in India are still paid out-of-pocket.

- Pandemic Realizations: COVID-19 pushed many families into debt due to lack of private medical insurance.

- Tax Savings: You can claim deductions under Section 80D—up to ₹25,000 for self/family and ₹50,000 for parents over 60, totaling ₹1 lakh.

Plans from providers like Liberty Health Insurance, Cigna Health Insurance, and Bupa Health Cover now offer coverage for telemedicine, mental health, and AI-driven claims processing—making them more relevant than ever in 2025.

What to Look for in the Best Health Insurance Policy

Choosing the best health insurance policy means considering several key elements:

Adequate Sum Insured

Urban dwellers should aim for ₹10–25 lakhs; ₹5–10 lakhs may suffice in smaller towns.

High Claim Settlement Ratio (CSR)

Trustworthy insurers like Care Health Insurance (CSR: 100%) and Niva Bupa (CSR: 92%) are ideal.

Network Hospitals

Search for health insurance near me to ensure cashless treatment at nearby hospitals. Plans like HDFC ERGO and Bupa have massive networks (10,000+ hospitals).

Pre-Existing Disease (PED) Waiting Period

A shorter waiting period, like ManipalCigna’s 90-day PED clause, is beneficial if you have ongoing health conditions.

Transparent Exclusions

Know what isn’t covered—like cosmetic surgeries or unproven treatments.

Additional Benefits

No-claim bonuses, OPD cover, and home care options can add long-term value.

The 5 Best Health Insurance Plans in India (2025)

1. Care Health Insurance – Care Supreme

Highlights:

- Coverage: ₹5 lakhs – ₹2 crores

- 500% No-Claim Bonus

- Covers AYUSH, non-medical items, maternity, and home care

- Premiums from ₹358/month

Pros:

- Massive 21,700+ hospital network

- Live-in partner coverage

- Ideal for families

Cons:

- Higher premiums for senior citizens

- Limited global reach

How It Saves You Lakhs: Unlimited restoration and high no-claim bonus ensure multiple hospitalizations are covered without added cost. Think of a ₹10 lakh cancer treatment—this policy could cover it in full without you spending a rupee out-of-pocket.

2. Niva Bupa – ReAssure 2.0

Highlights:

- Coverage: ₹5 lakhs – ₹1 crore

- Forever Restoration after every claim

- 10,400+ network hospitals

- Maternity, newborn, and virtual doctor consults included

Pros:

- Fast claim approval within 30 minutes

- No room rent caps

- Excellent customer experience via mobile app

Cons:

- Higher costs for entry-level plans

- Limited AYUSH coverage

How It Saves You Lakhs: A ₹15 lakh heart surgery could be cashless and fully restored for future claims. Plus, the policy reduces future premiums with wellness incentives.

3. HDFC ERGO – Optima Secure

Highlights:

- Sum Insured: ₹5 lakhs – ₹50 lakhs

- Retains no-claim bonus even after a claim

- Covers air ambulance, AYUSH, and daycare

- Massive 15,000+ hospital network

Pros:

- Flexible payment terms

- High CSR

- Trusted brand

Cons:

- Needs add-ons for critical illness

- Premiums rise with age

4. Aditya Birla – Activ Care (Senior Citizens)

Highlights:

- Sum Insured: ₹3 lakhs – ₹25 lakhs

- No co-pay for seniors

- 21% return on premium via wellness tracking

- 90-day PED coverage available

Pros:

- Ideal private medical insurance for elderly parents

- Teleconsultations and wellness rewards

- Air ambulance and home nursing

Cons:

- Less suitable for young families

- High premium for high coverage

How It Saves You Lakhs: A senior needing cataract surgery (₹40,000 per eye) won’t need to pay anything. Bonus: 21% of your premium may come back to you.

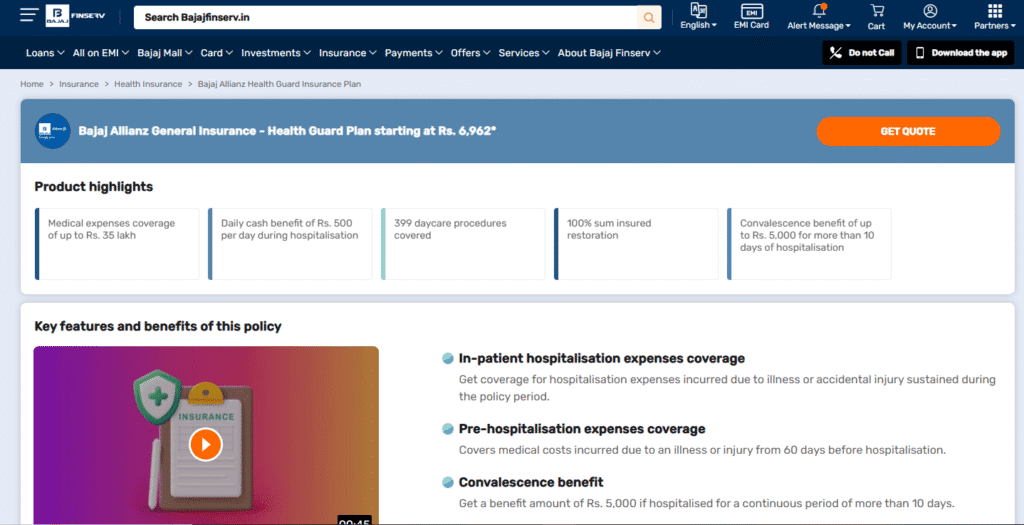

5. Bajaj Allianz – Health Guard Gold

Highlights:

- Coverage: ₹5 lakhs – ₹50 lakhs

- Competitive starting premium (₹1,469)

- OPD, maternity, and daycare included

- Trusted network of 10,000+ hospitals

Pros:

- Family-friendly

- Simple claims via app

- High CSR

Cons:

- No unlimited restoration

- Lacks global benefits

How It Saves You Lakhs: A single ₹10 lakh claim (e.g., chemotherapy) can be cashless. Add the no-claim bonus and tax deduction—this policy is a powerhouse for middle-income families.

How These Health Insurance Plans Can Save You Lakhs

| Feature | How It Saves You |

|---|---|

| Cashless Treatment | No upfront payment at trusted hospitals like in Niva Bupa or HDFC ERGO plans |

| Unlimited Restoration | Ensures back-to-back hospitalizations are covered (e.g., Care Supreme) |

| No-Claim Bonuses | Cumulative benefits like 500% boost your sum insured for free |

| Preventive Health | Early disease detection via check-ups saves ₹5–10 lakhs in late-stage treatments |

| Tax Benefits | Up to ₹1 lakh savings annually under Section 80D |

Choosing the Right Health Care Insurance Plan

Understand Your Needs

Are you buying for a nuclear family in a metro or for aging parents in a tier-2 city? Needs vary.

Compare Online

Check medical insurance quotes and CSR on platforms like Policybazaar, Ditto, or InsuranceDekho.

Check Network Hospitals

Search “health insurance near me” and ensure your local hospitals are covered.

Disclose Honestly

Don’t hide pre-existing diseases—plans like Cigna Health Insurance and ManipalCigna reward honesty with early PED coverage.

Look for Lifetime Renewability

Don’t choose plans that expire at 65 or 70—invest in your lifelong protection.

Common Pitfalls to Avoid

- Low Premium Trap: Don’t opt for a ₹2 lakh plan that won’t even cover a basic bypass surgery.

- Ignoring Exclusions: Always read what’s not covered.

- Skipping Fine Print: Co-pays, limits, and room rent caps can haunt you later.

- Choosing Low CSR Insurers: Always stick to reliable providers like Liberty Health Insurance or Care Health Insurance.

Final Words: Secure Your Health, Protect Your Wealth

The five Health Insurance Plans covered above offer more than just medical cover—they provide confidence in times of crisis. In a year where healthcare costs are only going up, these plans can literally save you lakhs.

Don’t procrastinate. Whether you’re looking for Cigna Health Insurance, Bupa Health Cover, or just trying to find the best health insurance policy for your budget, act today.

Use trusted platforms like IRDAI, Policybazaar, or Ditto to get medical insurance quotes, compare plans, and safeguard your future.

FAQs – Health Insurance Plans

Which health insurance is best?

The best health insurance varies based on your needs, but top-rated insurers in India include Care Health Insurance, Star Health, Niva Bupa, HDFC ERGO, and Tata AIG. These companies offer comprehensive plans with high claim settlement ratios, wide hospital networks, and features like cashless treatment, no-claim bonus, and critical illness cover. For individuals, a comprehensive individual plan is ideal, while families can opt for a family floater. If you’re salaried or planning long-term security, look for plans with lifetime renewability and pre/post-hospitalization benefits. Always compare policy features, premium, and exclusions before buying the best health insurance for you.

Which is the best health insurance cover?

The best health insurance cover depends on your age, family size, lifestyle, and medical history. For most individuals, a comprehensive health insurance plan with a sum insured of ₹10–25 lakh is ideal. Plans from insurers like Care Health Insurance, HDFC ERGO, Star Health, and Niva Bupa offer wide coverage, cashless hospital networks, and minimal claim hassles. Look for features like no-claim bonus, lifetime renewability, daycare procedures, and pre/post-hospitalization coverage. For families, a family floater plan is cost-effective. Always compare plans based on benefits, claim settlement ratio, and premium before choosing the best cover.

What is better, health insurance or mediclaim?

Health insurance is generally better than mediclaim because it offers comprehensive coverage beyond just hospitalization. While mediclaim policies only reimburse actual hospital expenses up to a fixed limit, health insurance plans cover a wide range of medical costs, including pre- and post-hospitalization, daycare procedures, ambulance charges, and even critical illnesses. Health insurance also allows you to choose from individual, family floater, and top-up plans, providing more flexibility and higher sum insured options. For better protection and long-term benefits, choosing a full-fledged health insurance plan over a basic mediclaim policy is the smarter decision.

Is 5 lakh medical insurance enough?

A ₹5 lakh medical insurance cover may be sufficient for individuals with no major health issues and living in smaller cities where treatment costs are lower. However, in metro cities like Mumbai or Delhi, hospitalization and surgery expenses can quickly exceed ₹5 lakh, especially for serious illnesses like cancer, cardiac issues, or surgeries. Medical inflation in India is rising at 10–15% annually, making healthcare costlier every year. For better protection, consider opting for a higher sum insured or a top-up health insurance plan. Always assess your family’s health needs and lifestyle before deciding your coverage amount.

Which health insurance is good and cheap?

Bajaj Allianz Health Guard Gold and Care Supreme offer affordable premiums with reliable coverage, making them good and budget-friendly health insurance options in 2025.

📌 Disclaimer:

EarnEdgeNow.com provides content for informational and educational purposes only. We do not provide investment, financial, or insurance advice. Always consult a certified advisor before making financial decisions. Some links in this post may be affiliate links, which means we may earn a commission if you purchase through them, at no extra cost to you. Thank you for supporting our content!

Piyush is the founder of EarnEdgeNow.com. He writes about online earning, investments, and job updates to help Indian youth grow smarter with money.